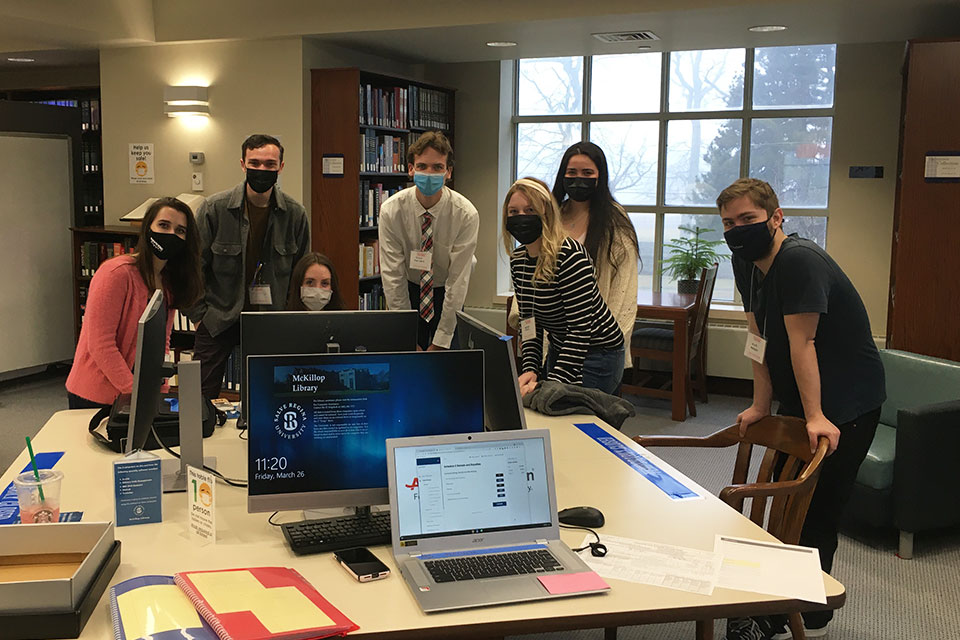

Certified students offering free tax preparation assistance

Salve Regina accounting students, in cooperation with AARP (American Association of Retired Persons), will offer free tax preparation assistance to any individual or family earning less than $53,000 annually on Wednesdays from 11-5pm until April 15 in McKillop Library.

Under the guidance of Paul McKillop, senior lecturer in the Department of Business Studies and Economics and a certified public accountant, the students have achieved advanced AARP certification necessary to prepare tax returns.

There are three tax preparation sites: Salve Regina’s McKillop Library, the Edward King House and the Portsmouth Senior Center. Students are volunteering at all three sites during the week until the tax season has concluded. Taxpayers cannot access the library if coming from outside the Salve Regina community, so they should call 401-341-2170 to make an appointment to drop off their materials.

Once the returns – both federal and state – are reviewed by the AARP controller, they will be e-filed. Open to the University community and the general public, the service is being provided on a first come, first served basis.

Those who are interested should bring the following:

- Social security card for self, spouse and all dependents (if applicable).

- Photo ID for self and spouse (if applicable).

- All 2020 W-2, 1099 and 1095-A forms.

- Stimulus payment received in 2020, called EIP1 and EIP2.

- Copy of last year’s return, if available.

- Any other forms received, typically these are 1098 and 1099 forms.

If there are any questions, direct them to Paul McKillop at mckillop@salve.edu.

This year the students preparing return and helping with the new COVID-19 procedure are: Ansen Cassady, Margaret Raposa, Abigail Joy, Hanna Fafard, Hana Couture, Drew Marzano, Nikki LeTourneau, Claire Matuga, Emma Zelepos, Nick Messer, Christopher Peasley, and Fernando Taborga. All students have passed the Advanced Certification for 2021.