Salve Regina students complete successful tax season with AARP Tax-Aide program

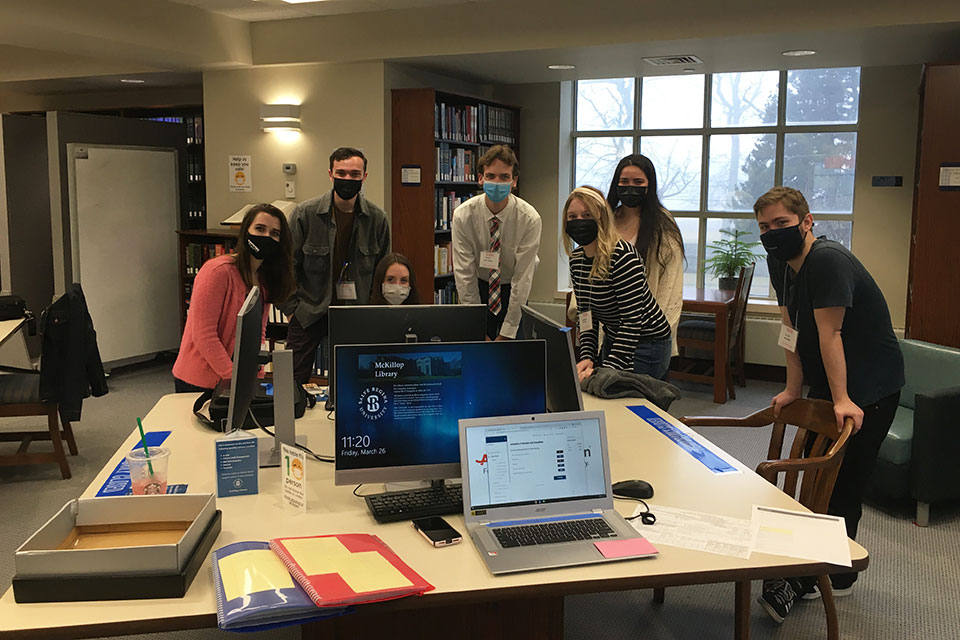

Twelve students working with Paul McKillop, senior lecturer in business and economics, just wrapped up a tax season where they completed over 300 income tax returns for Newport County citizens. The students, who are in tax and finance classes at Salve Regina, worked in coordination with the American Association of Retired Persons (AARP) Tax-Aide program at three sites — including McKillop Library; the Edward King House Senior Center in Newport, Rhode Island; and the Portsmouth Senior Center in Portsmouth, Rhode Island.

“A few of the student volunteers were able to receive internship credit, but the majority were willing to give up two to three days per week just to help the community,” said McKillop, lauding the dedication these students exhibited. “This effort starts in early January and ended this year one week before the end of term, although we are still doing lingering returns even now.”

Overall, more than 500 returns have been filed for 2020 tax season, with over 150 coming out of McKillop Library at Salve Regina — the biggest number ever to be done at the library. Over half of the returns completed in the city of Newport for AARP were prepared by Salve Regina interns. Intern student Drew Marzano ’22 led with 103 return preparations this year, followed by Emma Zelepos ’22 with 51, and Abigail Joy ’22 with 49.

“It was a really amazing experience to help out in the community,” said Joy, an accounting major at Salve Regina. “It was nice to see the direct impact that we were able to make and seeing just how appreciative so many people were to have our help. The experience gained through the program was a direct application of topics that we had learned in class, and this is experience that many of us will be able to use for years to come in our professional careers.”

This year the Salve Regina interns were critical, as many AARP preparers fell into high-risk COVID-19 categories, and were reluctant to expose themselves in public situations. All sites, including McKillop Library, were operated in a low contact drop-off model, with materials picked up outside and tax returns prepared inside. Face-to-face discussion was sorely missed, but the virtual method worked out with a lot of phone calls and emails.

“Being able to provide such a niche skill to the locals, get them money back on their taxes and remove those worries from their plate in an already difficult year for many felt gratifying,” said Ansen Cassady, an early senior graduating in December 2021 with a major in accounting and a business administration minor. “We had a lot of hurdles to overcome with shifting tax guidelines, both on a federal and state level, but Professor McKillop and the other AARP members helped us navigate through them.”

The AARP program has been working with McKillop and his students for seven years, beginning in 2015 with just 40 returns. The real world accounting and tax preparation experience gained with AARP has proven valuable, as the students graduate and move out into jobs with accounting firms and banks.

“For our students to work for [AARP’s tax service], we required all students back in the fall semester to pass three advanced certifications,” said McKillop. “We made this part of the Federal Tax I curriculum. Many of these students will go on to become CPAs or work in finance, so it was a nice correlation. Also, we scored a 10/10 when the IRS audited our site at McKillop Library…. I am very proud and grateful to my students, and believe me when I say that the outside community was so thankful to the Salve students for their undying help.”